Book review

Journal title FINANCIAL REPORTING

Author/s Simone Aresu

Publishing Year 2015 Issue 2014/2-3-4

Language English Pages 8 P. 171-178 File size 171 KB

DOI 10.3280/FR2014-002008

DOI is like a bar code for intellectual property: to have more infomation

click here

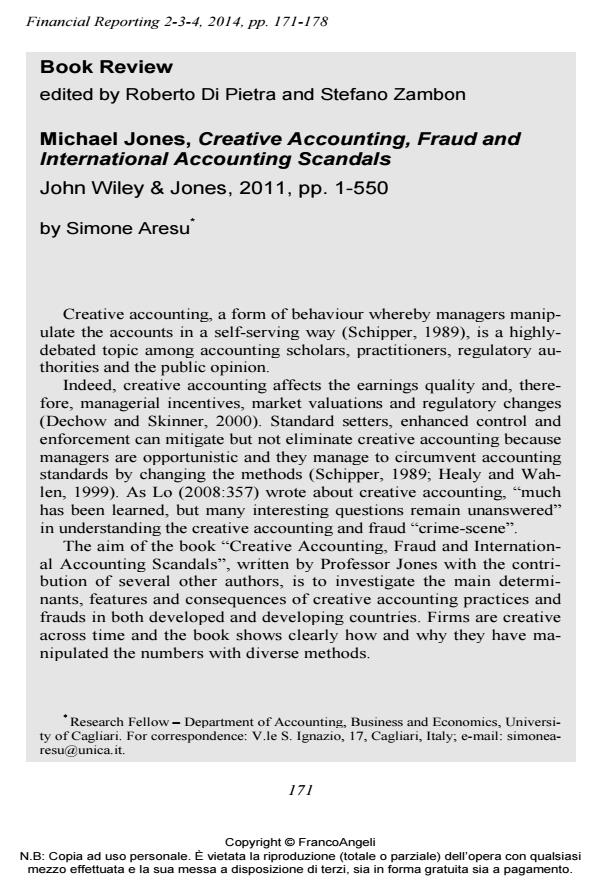

Below, you can see the article first page

If you want to buy this article in PDF format, you can do it, following the instructions to buy download credits

FrancoAngeli is member of Publishers International Linking Association, Inc (PILA), a not-for-profit association which run the CrossRef service enabling links to and from online scholarly content.

Simone Aresu, Book review in "FINANCIAL REPORTING" 2-3-4/2014, pp 171-178, DOI: 10.3280/FR2014-002008