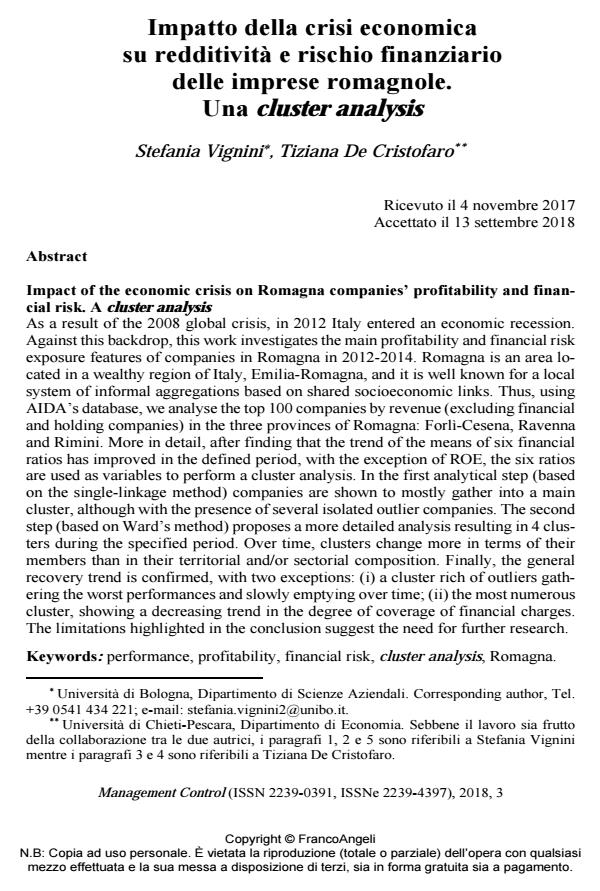

Impatto della crisi economica su redditività e rischio finanziario delle imprese romagnole. Una cluster analysis

Titolo Rivista MANAGEMENT CONTROL

Autori/Curatori Stefania Vignini, Tiziana De Cristofaro

Anno di pubblicazione 2018 Fascicolo 2018/3

Lingua Italiano Numero pagine 25 P. 157-181 Dimensione file 313 KB

DOI 10.3280/MACO2018-003008

Il DOI è il codice a barre della proprietà intellettuale: per saperne di più

clicca qui

Qui sotto puoi vedere in anteprima la prima pagina di questo articolo.

Se questo articolo ti interessa, lo puoi acquistare (e scaricare in formato pdf) seguendo le facili indicazioni per acquistare il download credit. Acquista Download Credits per scaricare questo Articolo in formato PDF

FrancoAngeli è membro della Publishers International Linking Association, Inc (PILA)associazione indipendente e non profit per facilitare (attraverso i servizi tecnologici implementati da CrossRef.org) l’accesso degli studiosi ai contenuti digitali nelle pubblicazioni professionali e scientifiche

;

Keywords:Performance, profitability, financial risk, cluster analysis, Romagna.

- Altman E.I. (1968), Financial ratios, discriminant analysis and the prediction of corporate bankruptcy, The journal of finance, 23, 4, pp. 589-609.

- Antonioli D., Bianchi A., Mazzanti M., Montresor S., Pini P., a cura di (2011), Strategie di innovazione e risultati economici: un’indagine sulle imprese manifatturiere dell’Emilia-Romagna, Milano, FrancoAngeli.

- Ausloos M., Bartolacci F., Castellano N.G., Cerqueti R. (2018), Exploring how innovation strategies at time of crisis influence performance: a cluster analysis perspective, Technology Analysis & Strategic Management, 30, 4, pp. 484-497. DOI: 10.1080/09537325.2017.1337889

- Barbaranelli C. (2006), Analisi dei dati con SPSS, Vol. II, Milano, Led.

- Bartolacci F., Paolini A., Quaranta A.G., Soverchia M. (2017), Performance economiche e ambientali nelle aziende italiane di igiene urbana: prime evidenze empiriche, Management Control, 2, pp. 33-51. DOI: 10.3280/MACO2017-002003

- Battilani P., Fauri F. (2009), The rise of a service-based economy and its transformation: seaside tourism and the case of Rimini, Journal of Tourism History, 1, 1, pp. 27-48. DOI: 10.1080/17551820902742756

- Beaver W.H. (1966), Financial ratios as predictors of failure, Journal of accounting research, 4, pp. 71-111.

- Beaver W.H., Kettler Scholes M. (1970), The association between market determined and accounting determined risk measures, The Accounting Review, 45, 4, pp. 654-682.

- Bellamy C. (2011), Principles of methodology: Research design in social science, Sage.

- Ben- Zion U. (1978), The investment aspect of nonproduction expenditures: An empirical test, Journal of Economics and Business, pp. 224-229.

- Bettis R.A., Mahajan V. (1985), Risk/return performance of diversified firms, Management Science, 31, 7, pp. 785-799.

- Bhattacharyya, D. K. (2006), Research methodology, Excel Books India.

- Bird R.G., McHugh A.J. (1977), Financial ratios – an empirical study, Journal of Business Finance & Accounting, 4, 1, pp. 29-46.

- Borroi M., Minoja M., Sinatra A. (1998), The relationship between cognitive maps, industry complexity and strategies implemented: the case of the Carpi textile-clothing industrial system, Journal of Management and Governance, 2, 3, pp. 233-266.

- Bougen P.D., Drury J.C. (1980), UK statistical distributions of financial ratios, 1975, Journal of Business Finance & Accounting, 7, 1, pp. 39-47.

- Brunetti G. (1971), Il sistema dei quozienti di bilancio: alcuni caratteri strutturali e funzionali, Milano, Giuffrè.

- Canavari M., Ghelfi R., Olson K.D., Rivaroli S. (2007), A comparative profitability analysis of organic and conventional farms in Emilia-Romagna and in Minnesota, in Canavari S., Olson K.D., a cura di, Organic Food, New York, Springer.

- Capece G., Cricelli L., Di Pillo F., Levialdi N. (2010), A cluster analysis study based on profitability and financial indicators in the Italian gas retail market, Energy Policy, 3, 7, pp. 3394-3402.

- Capece G., Cricelli L., Di Pillo F., Levialdi N. (2012), New regulatory policies in Italy: Impact on financial results, on liquidity and profitability of natural gas retail companies, Utilities Policy, 23, 90-98.

- Capon N., Farley J.U., Hoenig S. (1990), Determinants of financial performance: a meta-analysis, Management science, 36, 10, pp. 1143-1159.

- Castellano N. (2011), Modelli e misure di performance aziendale: analisi della letteratura e spunti di ricerca, Management Control, 1, pp. 41-63. DOI: 10.3280/MACO2011-001003

- Chen K.H., Shirmeda T.A., (1981), An Empirical Analysis of Useful Financial Ratios, in Financial Management, 10, 1, pp. 51-60.

- Cinquini L., Miraglia R.A., Giannetti R. (2016), Editoriale. Strumenti di gestione dei costi e misure di performance negli attuali contesti competitivi, Management Control, 2, pp. 5-14. DOI: 10.3280/MACO2016-002001

- Creswell J.W. (2009), Research design. Qualitative, quantitative and mixed methods approach, Sage.

- Dardac N., Giba A. (2011), Systemic Financial Crises: A Cluster Analysis, European Research Studies, 14, 2, pp. 53-64.

- de Lillo A., Argentin G., Lucchini M., Sarti S., Terraneo M., a cura di (2007), Analisi multivariata per le scienze sociali, Pearson Italia.

- Deakin, E. (1976), Distributions of financial accounting ratios: some empirical evidence, The Accounting Review, 51, 1, pp. 90-96.

- Dolnicar S. (2002), A review of unquestioned standards in using cluster analysis for data-driven market segmentation. Faculty of Commerce-Papers, 273. -- Http://ro.uow.edu.au/commpapers/273.

- Ennas M. (2010), Elementi di cluster analysis per la classificazione e il posizionamento nelle ricerche di marketing. -- Http://www.mauroennas.eu/ita/phocadownload/report/01_cluster_analysis.pdf.

- Ezzamel M., Mar-Molinero C. (1990), The distributional properties of financial ratios in UK manufacturing companies, Journal of Business Finance & Accounting, 17, 1, pp. 1-29.

- Ezzamel M., Mar-Molinero C., Beecher A. (1987), On the distributional properties of financial ratios, Journal of Business Finance & Accounting, 14, 4, pp. 463-481.

- Fasone V., Puglisi M. (2017), Misure di performance innovative e modelli di business: il caso delle aziende aeroportuali italiane, Management Control, 2, pp. 89-123. DOI: 10.3280/MACO2017-002005

- Foster G. (1978), Financial Statement Analysis, Englewood Cliffs, Prentice-Hall.

- Frecka, T.J., Hopwood, W.S. (1983), The effects of outliers on the cross-sectional distributional properties of financial ratios, The Accounting Review, 58, 1, pp. 115-128.

- Galeotti M., Garzella S., Fiorentino R., Della Corte G. (2016), The Strategic Intelligence implications for Information Systems, Management Control, 1, pp. 105-123. DOI: 10.3280/MACO2016-001007

- Gordon I.R., McCann P. (2000), Industrial clusters: complexes, agglomeration and/or social networks?, Urban studies, 37, 3, pp. 513-532. DOI: 10.1080/0042098002096

- Gremillet A. (1979), Les ratio set leur utilisation, Parigi, Les éditions d’organisation.

- Griliches Z. (1972), Cost allocation in railroad regulation, The Bell Journal of Economics and Management Science, 3, 1, pp. 26-41.

- Gupta M.C., Huefner R.J. (1972), A cluster analysis study of financial ratios and industry characteristics, Journal of Accounting Research, 10, 1, pp. 77-95.

- Hall B.H. (1987), The relationship between firm size and firm growth in the U.S. manufacturing sector, Journal of Industrial Economics, 35, pp. 583-605.

- Hambrick D.C., Schecter S.M. (1983), Turnaround strategies for mature industrial-product business units, Academy of Management Journal, 26, 2, pp. 231-248.

- Harrigan K.R. (1985), An application of clustering for strategic group analysis, Strategic Management Journal, 6, 1, pp. 55-73.

- Hopwood W., Mckeown J., Muchler J.F. (1988), The sensitivity of financial distress prediction models to departures from normality, Contemporary Accounting Research, 5, 1, pp. 284-298.

- Horrigan J.O. (1965), Some Empirical Bases of Financial Ratio Analysis, The Accounting Review, 40, 3, pp. 558-568.

- Horrigan J.O. (1966), The Determination of Long-Term Credit Standing with Financial Ratios, Journal of Accounting Research, 4, pp. 44-62.

- Istat, Unioncamere, a cura di (2007), L’evoluzione dei sistemi locali in Emilia-Romagna, Bologna, Maggioli.

- Kantar E., Keskin M., Deviren B. (2012), Analysis of the effects of the global financial crisis on the Turkish economy, using hierarchical methods, Physica A: Statistical Mechanics and its Applications, 391, 7, pp. 2342-2352.

- Karels, G.V., Prakash, A.J. (1987), Multivariate normality and forecasting of business bankruptcy, Journal of Business Finance & Accounting, 14, 4, pp. 573-593.

- Ketchen D.J. Jr, Shook C.L. (1996), The application of cluster analysis in strategic management research: an analysis and critique, Strategic Management Journal, 17, 6, pp. 441-458.

- Lev B., Sunder S. (1979), Methodological issues in the use of financial ratios, Journal of Accounting and Economics, 1, 3, pp. 187-210.

- Marchi L. (2014), Nuove prospettive di valutazione delle performance nelle aziende di servizi, Management Control, 1, pp. 5-8. DOI: 10.3280/MACO2014-001001

- McLeay S. (1986b), Student’s t and the distribution of financial ratios, Journal of Business Finance & Accounting, 13, 2, pp. 209-222.

- McLeay S. (1986a), The ratio of means, the mean of ratios and other benchmarks, Finance, Journal of the French Finance Society, 7, 1, pp. 75-93.

- McLeay S., Omar S. (2000), The sensitivity of prediction models to the non-normality of bounded and unbounded financial ratios, British Accounting Review, 32, 2, pp. 213-230.

- Morosini P. (2004), Industrial clusters, knowledge integration and performance, World development, 32, 2, pp. 305-326.

- Nerlove M. (1968), Factors affecting differences among rates of return on investments in individual common stocks, The Review of Economics and Statistics, 50, 3, pp. 312-331.

- O’Connor M.C. (1973), On the Usefulness of Financial Ratios to Investors in Common Stock, The Accounting Review, 48, 2, pp. 339-352.

- Ohlson J. (1980), Financial ratios and probabilistic prediction of bankruptcy, Journal of Accounting Research, 18, 1, pp. 109-131.

- Onida P. (1947), Le discipline economico-aziendali, Milano, Giuffrè.

- Paganelli O. (1991), Analisi di bilancio. Indici e flussi, Torino, Utet.

- Paoloni M., Celli M., (2018), Crisi delle PMI e strumenti di warning. Un test di verifica nel settore manifatturiero, Management Control, 2, pp. 85-106. DOI: 10.3280/MACO2018-002005

- Pinches G.E., Eubank A.A., Mingo K.A., Caruthers J.K. (1975), The hierarchical classification of financial ratios, Journal of Business Research, 3, 4, pp. 295-310.

- Pivoňka, T., Löster, T. (2013), Cluster Analysis as a Tool of Evaluating Clusters of the EU Countries before and during Global Financial Crisis from the Perspective of the Labor Market. Intellectual Economics, 7, 4, pp. 411-425. DOI: 10.13165/IE-13-7-4-01

- Punj G., Stewart D.W. (1983), Cluster analysis in marketing research: review and suggestions for application, Journal of marketing research, 20, 2, pp. 134-148.

- Pyke F., Becattini G., Sengenberger W., a cura di (1990), Industrial districts and inter-firm cooperation in Italy, Ginevra, IILS.

- Rhys H., Tippett M. (1993), On the ‘Steady State’ Properties of Financial Ratios, Accounting and Business Research, Taylor & Francis.

- Rodrigues L., Rodrigues L. (2018), Economic-financial performance of the Brazilian sugarcane energy industry: An empirical evaluation using financial ratio, cluster and discriminant analysis, Biomass and Bioenergy, 108, pp. 289-296.

- Sarstedt M., Mooi E. (2014), A concise guide to market research. The process, data and methods using IBM SPSS Statistics, Heidelberg, Springer.

- Stigler G.J. (1963),Capital and rates of return in manufacturing industries, Princeton University Press, NBER.

- Tippett M. (1990), An Induced Theory of Financial Ratios, Accounting and Business Research, 21, 81, pp. 77-85.

- Wang Y.J., Lee H.S. (2008), A clustering method to identify representative financial ratios. Information Sciences, 178, 4, pp. 1087-1097.

- Watson C.J. (1990), Multivariate distributional properties, outliers, and transformation of financial ratios, The Accounting Review, 65, 3, pp. 682-695.

- Wilcox J.W. (1971), A Simple Theory of Financial Ratios As Predictors of Failure, Journal of Accounting Research, 9, 2, pp. 389-395.

- Zeli A., Mariani P. (2009), Productivity and profitability analysis of large Italian companies: 1998-2002, International Review of Economics, 56, 2, pp. 175-188.

Stefania Vignini, Tiziana De Cristofaro, Impatto della crisi economica su redditività e rischio finanziario delle imprese romagnole. Una cluster analysis in "MANAGEMENT CONTROL" 3/2018, pp 157-181, DOI: 10.3280/MACO2018-003008